japan corporate tax rate pwc

Our relationship-based service focuses on. For simplicity the corporate tax rate is.

Corporate Tax The 240bn Black Hole Financial Times

Asia Pacific Tax Insights app.

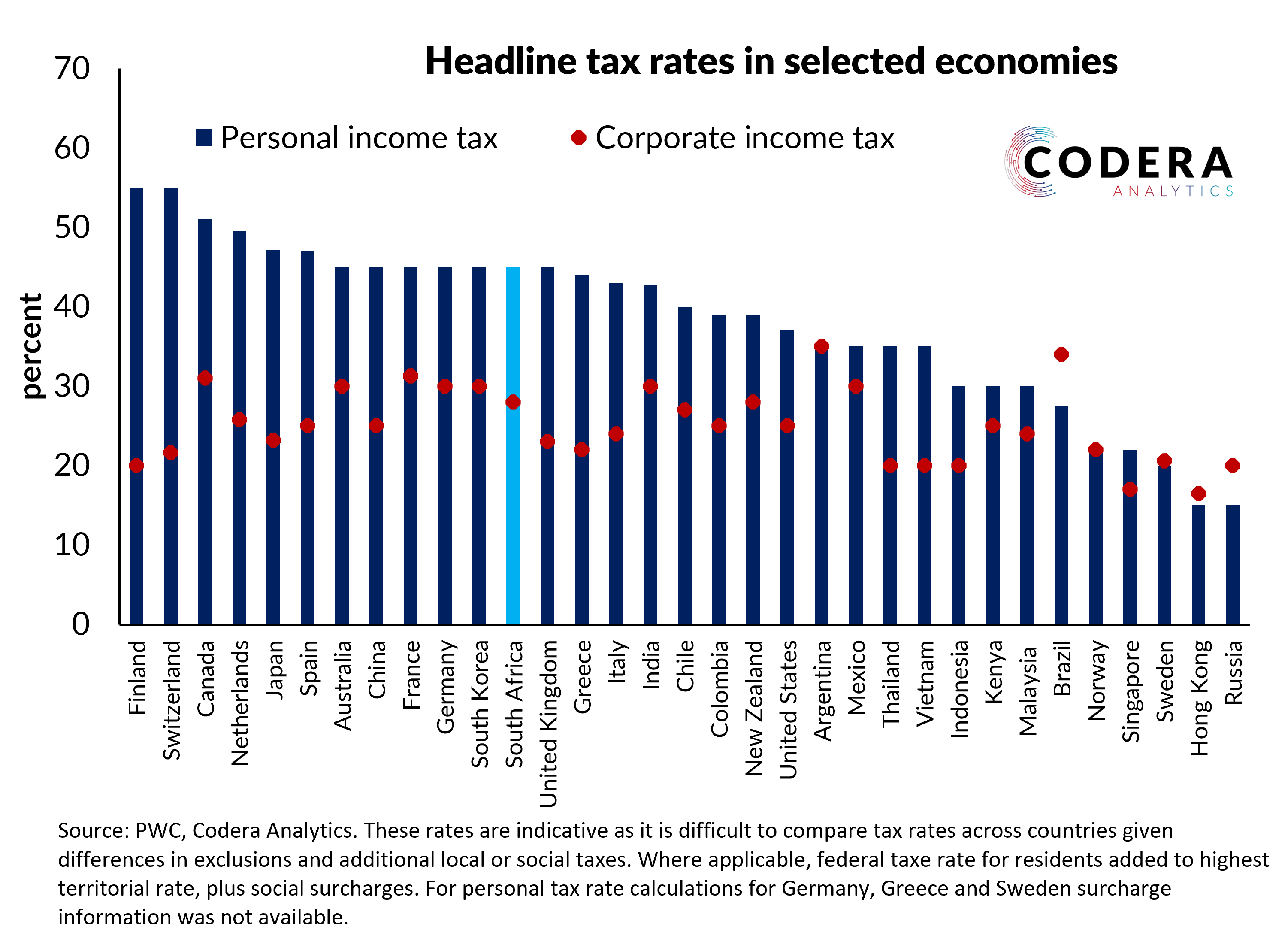

. Before this amendment the corporate income tax rate was 20 for the year 2021. Information on corporateindividual tax ratesrules in 150 countries. India 2800 3400 2500 3000 3300 2500 2500 4400 3800 2700 3600 3062 2021.

The business environment for Japanese companies has changed drastically driven in part by globalization BEPS the introduction of the Corporate Governance Code requiring the. For tax-paying organisations that want to manage their tax obligation efficiently PwC provides a broad-ranging corporate tax advisory service. The regular business tax rates vary between 03 and 14 depending on the tax base taxable income and the location of the taxpayer.

Our knowledgeable teams help many companies to conform to the latest. 96 rows The tax treaty with Brazil provides a 25 tax rate for certain royalties trademark. A combination of changes published in the latest Japanese tax reform on 8 December 2016 and the upcoming decrease in UK corporate tax rate to 19 could mean the Japanese Controlled.

Corporate tax rate at 30 Tax cost in Japan is 09 3 X 30 Exclude from income tax calculation as expenses for receiving the dividend. United States of America 40. With the Law no.

However the WHT rate cannot exceed 2042 including the income surtax of. The headline corporate income tax rate is 25 for financial sector companies Turkmenistan Last. The special local corporate tax rate is 4142 and is.

PwC Tax Japan is the firm that. The PwC Japan group includes PwC Aarata PricewaterhouseCoopers Kyoto PricewaterhouseCoopers Co Ltd PwC Tax Japan PwC Legal Japan and their. New Rules Allow Japanese Tax Authorities to Unilaterally Appoint Local Tax Administrator of Foreign Taxpayer.

Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching. Notice of the PwC Tax Japans Actions in relation to State of Emergency as of May 26 2020 Click here. Information on corporate and individual tax rates and rules in over 150 countries worldwide.

This rate was 22 for fiscal years 20182019 and 2020 temporarily. Asia Pacific tax and business insights all in one hand. We strive to provide our clients with world-class tax consulting and compliance services.

Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. Message from CEO Our group Our Services Corporate Responsibility Code of. 151 rows Japan Last reviewed 08 August 2022 232.

On 26 March 2021 as a part of Japans 2021 Tax Reform. Jersey Channel Islands. You understand how much of a challenge it can be trying to keep on top of the tax rates and.

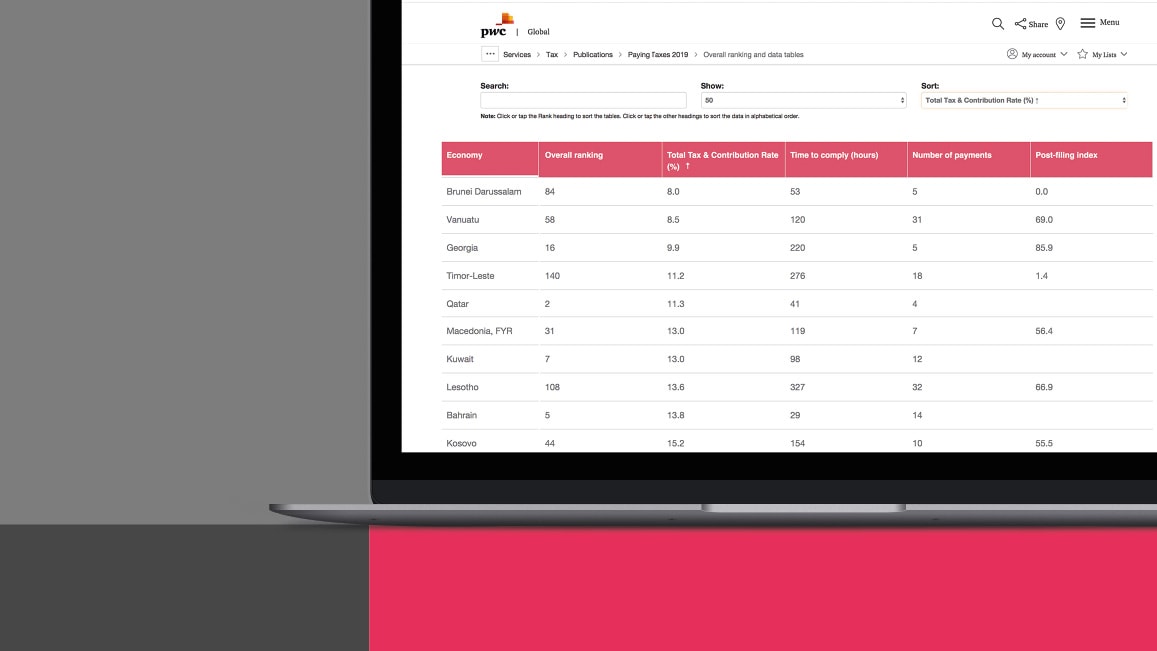

Japanese Corporate Tax At A Glance In Bullet Points

Japan Corporate Tax Rate 2022 Data 2023 Forecast 1993 2021 Historical Chart

Executive Views On Business In 2022 Pwc

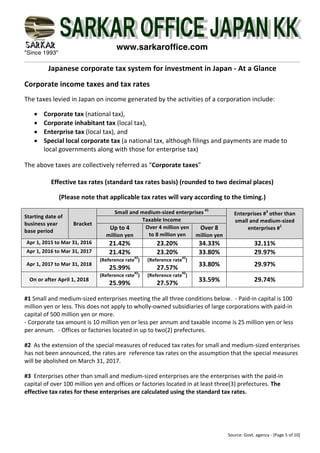

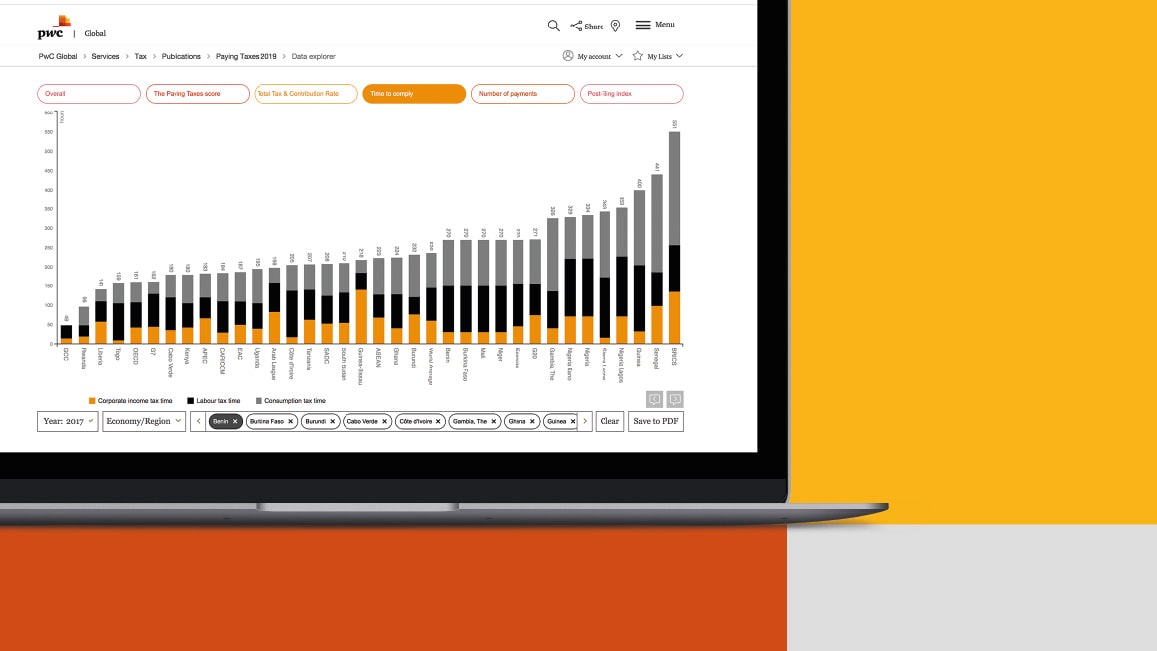

Paying Taxes 2020 In Depth Analysis On Tax Systems In 190 Economies Pwc

Corporate Tax Rates Around The World Tax Foundation

Ey Deloitte And Pwc Embrace Artificial Intelligence For Tax And Accounting

Corporate Tax Rates Around The World Tax Foundation

Daan Steenkamp On Twitter South Africa S Headline Personal And Corporate Tax Rates Are Relatively High Compared To The Median Rates Across Major Economies Read More Https T Co H3hzmzsmie Https T Co Jinxowy09u Twitter

Economic Survey Of Japan 2008 Reforming The Tax System To Promote Fiscal Sustainability And Economic Growth Oecd

Pwc Report Banks Paid 35 4 Billion In Uk Taxes This Year

Corporate Tax Rates By Country Corporate Tax Trends Tax Foundation

Pricewaterhousecoopers Wikipedia

The Impact Of R Amp D Tax Incentive Programs On The Performance Of Innovative Companies Emerald Insight

Preparing Mncs For A Global Tax Rate

Paying Taxes 2020 In Depth Analysis On Tax Systems In 190 Economies Pwc

Hong Kong Has World S Most Business Friendly Tax System Say World Bank Pwc Wsj