accumulated earnings tax reasonable business needs

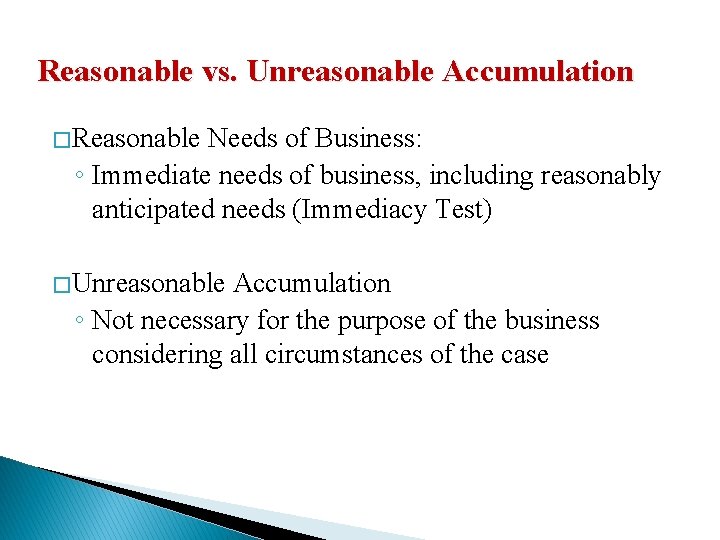

Pest Corporation also had the following information for 2021. Whether a particular ground or grounds for the accumulation of earnings and profits indicate that the earnings and profits have been accumulated for the reasonable needs of the business or beyond such needs is dependent upon the particular circumstances of the case.

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Needs of the business.

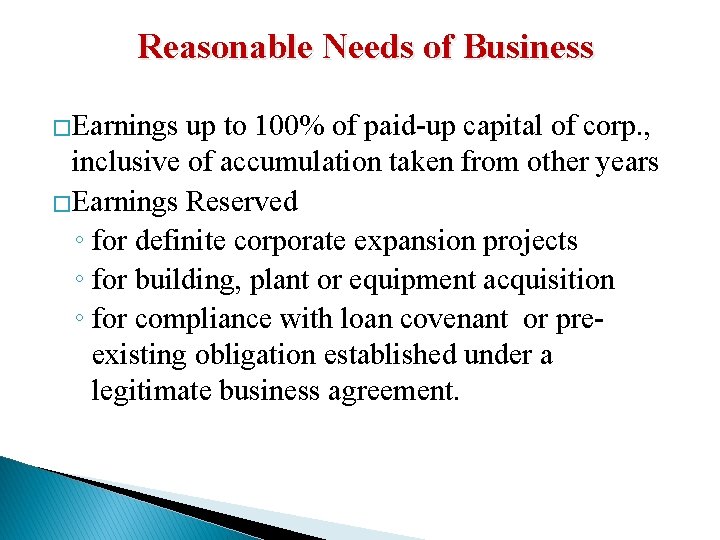

. An additional earnings accumulation of 60000 for the current year can be justified as meeting the reasonable needs of the business. Business expansion constructing a new facility and investing in newer and more productive equipment are reasonable business needs. Specific definite and feasible plans of usage for the accumulated earnings.

Regular Taxable Income - 5300000. List several examples of what is included and several examples of what is not included in the reasonable needs of the business. Pest Corporation Total Reasonable Business Needs for 2021 was 290000.

The IRS defines some of the criteria that meet the reasonable needs condition. CONTACT SCHAUMBURG 1051 Perimeter Drive 9th Floor. The accumulated earnings tax is equal to 20 of the accumulated taxable income and is imposed in addition to other taxes required under the Internal Revenue Code.

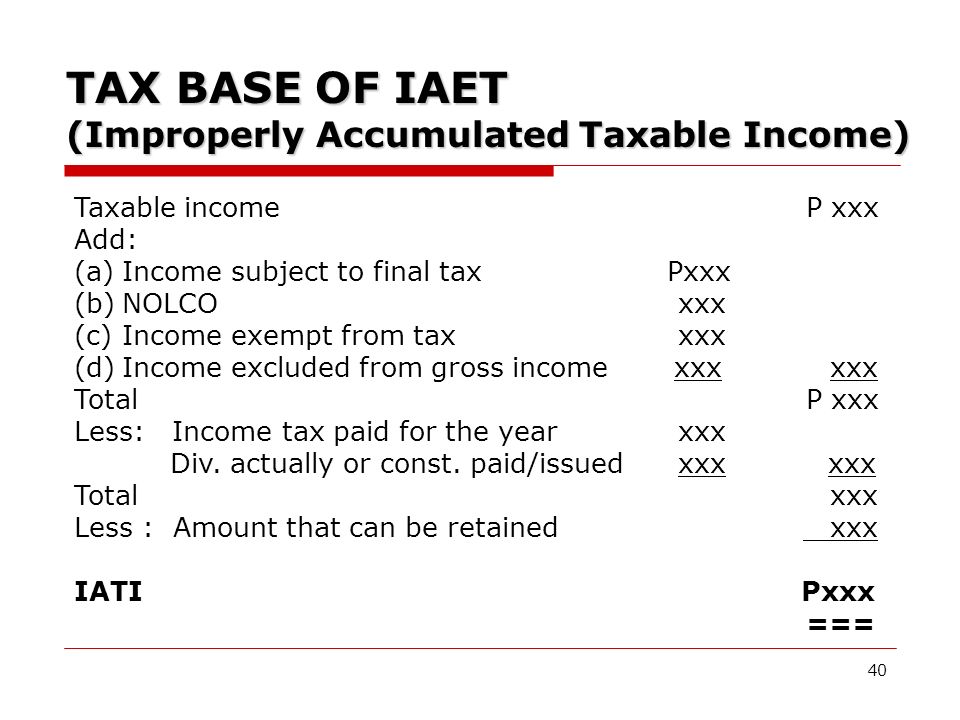

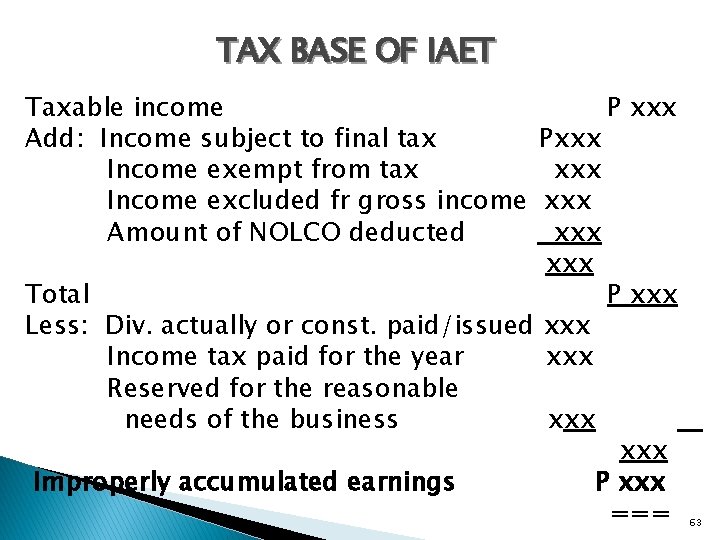

Within the reasonable needs of the business rubric. And profits have been allowed to accumulate beyond the reasonable. 1 Accumulated taxable income is taxable income modified by adjustments in 535 b and as reduced by the dividends paid deduction under 561 and the accumulated earnings tax credit under 535 c.

The need to retain earnings and profits. 1537-2a Income Tax Regs. The Tax Code defines reasonable needs to include the reasonably anticipated needs of the business.

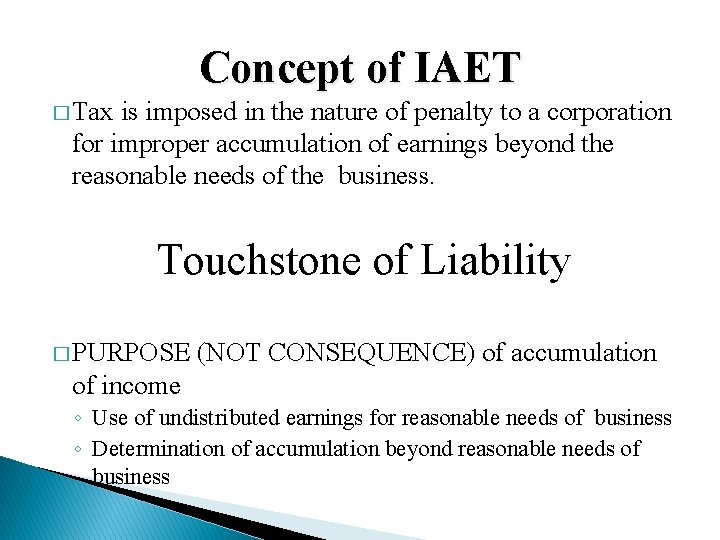

REASONABLE NEEDS OF THE BUSINESS. Accumulated Earnings Tax IRC 531 The purpose of the accumulated earnings tax is to prevent a corporation from accumulating its earnings and profits beyond the reasonable needs of the business for the purpose of avoiding income taxes on its stockholders. Talk to your accountant if you have accumulated earnings or anticipate earning above the allotted amounts in order to take the proper steps of documentation to strengthen your case and avoid this tax.

Anticipated needs of the business. Percent of the accumulated taxable income in excess of. The accumulation of reasonable amounts for the payment of reasonably anticipated product liability losses as defined in section 172f as in effect before the date of enactment of the Tax Cuts and Jobs Act as determined under regulations prescribed by the Secretary shall be treated as accumulated for the reasonably anticipated needs of the business.

The statutory accumulated earnings tax exemption has been used up in prior years. A long-term capital gain of 50000 is included in taxable income. Tion 303 relating to payment of a deceased shareholders estate taxes.

Reasonable business needs include any of the following. Corporate minutes should include records of business reasons justifying the accumulated earnings. The AET is a penalty tax imposed on corporations for unreasonably accumulating earnings.

S corporations dont have a problem with accumulated earnings because earnings are taxed to S corporation shareholders even if theyre not distributed to them. Corporation described in section 532 an accumulated earnings tax equal to the sum of- 1 27V2 percent of the accumulated taxable income not in excess of 100000 plus 2 381 percent of the accumulated taxable income in excess of 100000. What is Lawrence Corporations accumulated earnings tax liability.

The tax rate on accumulated earnings is 20 the maximum rate at which they would be taxed if distributed. It is presumed that a corporation can retain up to 25000000 or 15000000 for certain service corporations for the. When applicable the accumulated earnings tax is levied at the rate of 27y percent of the first 100000 of accumulated taxable income and at.

Redemption needs in certain situations. An accumulation of the earnings and profits including the undistributed earnings and profits of prior years is in excess of the reasonable needs of the business if it exceeds the amount that a prudent businessman would consider appropriate for the present business purposes and for the reasonably anticipated future needs of the business. And other qualifying expenses.

Use the IRS Online Tax Calendar. Retain earnings for reasonable business needs and document them in a specific definite and feasibleplan. To be subject to the accumulated earnings tax the corporation generally must accumulate earnings beyond its reasonable business needs.

250000 for nonservice corporations only The accumulated earnings tax which is imposed on corporations for the accumulation of earnings in excess of. Or Do not keep an accumulated earnings balance that exceeds 250000 or 150000 for personal service corporations What Are Some Examples of Reasonable Business Needs. Accounting questions and answers.

Business needs before the accumulated earnings tax is imposed. View the full answer. And 3 redemptions of stock from a.

The accumulated earnings tax equals 396 percent of accumulated taxable income and is in addition to the regular corporate tax. 2 redemptions in connection with sec-. Expert Answer For purposes of the accumulated earnings tax earnings can be accumulated for reasonable needs of the business.

The company plans to use accumulated earnings as a measure to anticipate product liability losses. 2-2001 includes as among the items which constitutes reasonable needs of the business the allowance for the increase in the accumulation of earnings up to 100 percent of the paid-up capital of the corporation. The corporation could be subject to the personal holding company PHC tax or the accumulated earnings tax but it is not subject to both of them because PHCs are exempt from the accumulated earnings tax.

However this opens the door to the Accumulated Earnings Tax AET if profits accumulate beyond the reasonable needs of the business. Reasonable needs of the business. Liability for the accumulated earnings tax is based on the following two conditions.

Pest Corporations Accumulated Earnings And Profits EP at the beginning of 2021 was 225000 oncluding consideration for the Dividends listed below.

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Income Tax Computation For Corporate Taxpayers Prepared By

Income Tax Computation For Corporate Taxpayers Prepared By

What Are Retained Earnings How To Calculate Retained Earnings Mageplaza

The Income Tax Rate Of Corporations Lowered In The Philippines Lawyers In The Philippines

Strategies For Avoiding The Accumulated Earnings Tax Krd

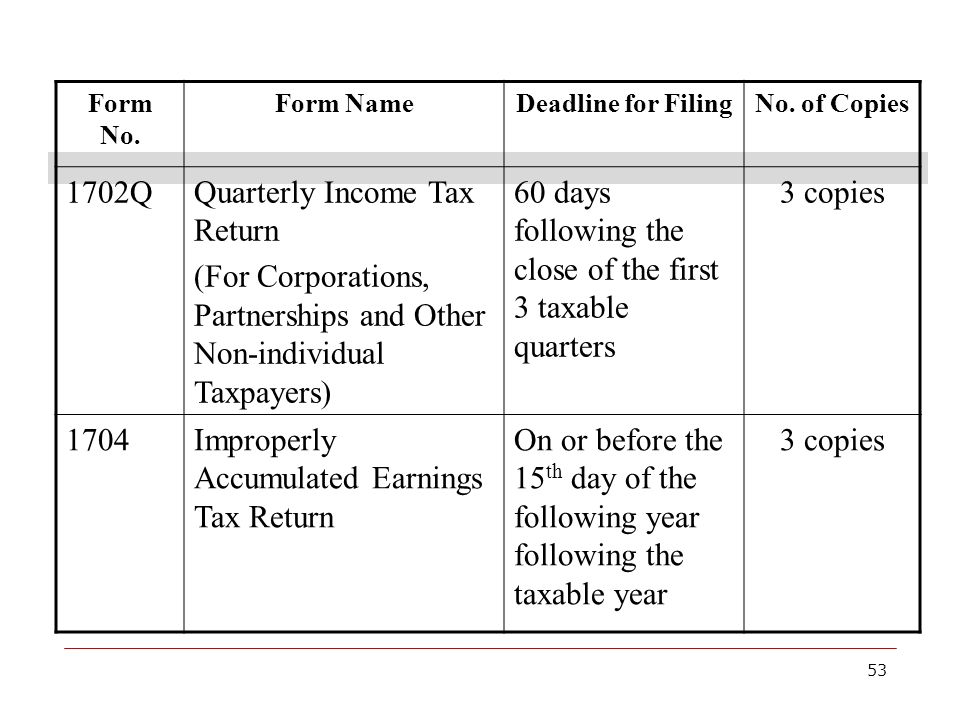

Overview Of Improperly Accumulated Earnings Tax In The Philippines Tax And Accounting Center Inc Tax And Accounting Center Inc

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Income Tax Computation For Corporate Taxpayers Prepared By

Accumulation Units The Income Tax Loophole That Never Was Monevator

/GettyImages-1130199515-b011f8c58a144789b22c7107929ffb8f.jpg)

Accumulated Earnings Tax Definition

Income Tax Computation For Corporate Taxpayers Prepared By

:max_bytes(150000):strip_icc()/GettyImages-1089395350-f33f180d2b234b268f6df527045f8de0.jpg)

Accumulated Earnings Tax Definition

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

Income Tax Computation For Corporate Taxpayers Prepared By